Why These 3 Canadian Cannabis Giants Shouldn’t Struggle with Oversupply

- Posted By : Greenweedfarms

- Uncategorized

- Leave a comment

Why These 3 Canadian Cannabis Giants Shouldn’t Struggle with Oversupply, There has been a lot of hand-wringing lately about the alleged oversupply of cannabis in Canada, fear in many ways that is unjustified at this time. Beyond the obvious, there are a number of reasons why oversupply isn’t going to be much of an issue for major producers like Aurora Cannabis (ACB), Canopy Growth (CGC) and Aphria (APHA). Among them are the increase in retail outlets in Canada, rapidly failing small competitors, wholesale options in the near term, conversion of dried flower to CBD, inevitable decline in black market sales, sales to research labs in the U.S., and an increase in international sales.

Because these three companies are the leaders in production capacity in Canada, they should disproportionately benefit from the increase in license retail stores being rolled out. The same goes for international sales, where all three companies have a decent presence, with Aurora Cannabis being the strongest with 25 markets it operates in.

Most of us are aware of these two elements associated with these companies. The majority of commentators and pundits base most of their ideas surrounding oversupply on those two aspects of the market. Even there they’re wrong because they don’t take into account the retail licensing factor, which is the major reason for weaker sales in the provinces.

Technically you could assert there was an oversupply because there is more supply than current market conditions justify, but that’s not because of lack of demand, but again, lack of stores to sell product in. This is starting to be addressed, and this will provide outlets for the increasing amount of supply coming from these pot giants.

What this has also done is provide an opening for the black market, where the lack of competition has allowed them to thrive much longer than expected, as there have been many geographic regions with very limited places to buy legal pot. That’s especially true in Toronto and Ontario as a whole. Legal retail outlets will put more pressure on illegal operations, and that will boost demand. It will also increase scale for the companies, presumably helping them cut costs while increasing revenue.

There is also no doubt that it won’t be long before many small competitors go out of business from the lack of capital, cash burn, and the inability to ever turn a profit. When they go out of business it will open the door for these companies to make up for the supply shortfall.

Another outlet for their cannabis is converting it into different CBD products, which in turn the companies sell. I haven’t seen too many people talk about this, as they look more toward recreational and medical cannabis for their supply outlook.

The other sales outlet not being considered, or if considered, being looked upon as a negative, rather than the positive option it is. One silly writer even called it “dumping” when commenting on Aurora Cannabis selling into the wholesale market during the last reporting period.

I consider it a positive because of the slow roll out of retail stores in Canada. Selling into the wholesale market while waiting for the stores to increase in number is a good use of cannabis for now. It would be irresponsible to just sit on it hoping it wouldn’t rot while waiting for the stores to open.

Last, there have been a couple of deals made with research labs in the U.S. to sell cannabis to. Of the companies focused on in this article, only Canopy Growth has made that type of deal, with the other being Tilray.

How much this has an impact on Canadian cannabis producers remains to be seen, as the existing deals appear to be only one-off deals. If the U.S. approves of more facilities, it would be easy to see this being a meaningful market for not only Canopy, but Aphria and Aurora Cannabis as well.

Aurora Cannabis (ACB)

One thing I’ve seen mentioned concerning Aurora Cannabis is it faces an oversupply issue. Some have even suggested it’s building too many facilities. I disagree strongly with that assessment, for the reasons mentioned above.

In a little over half a year Aurora is going to be the market leader in production capacity by a wide margin. While that would be a negative factor in the near term because of the appearance of too much supply for the Canadian market, but like I said, that’s something that is being remedied because the demand is already there.

And when taking into account the decline in smaller competitors, the shrinking of the black market, wholesale options, and growing international demand, Aurora has plenty of outlets to sell its pot through for a long time.

The number of competitors is going to contract, not expand, and that’s good news for Aurora. It’s very probable that by time of the end of June 30, 2020, many will have fallen by the wayside at the time Aurora approaches full production capacity. I see this and the shrinking black market as key catalysts for Aurora in the years ahead.

The metric to follow in my view is the pace of the opening of retail stores across Canada. As more and more are operational, it will put more pressure on the black market and smaller producers who will struggle to meet demand.

Ladenburg analyst Glenn G Mattson noted “While some producers are concerned about oversupply in the coming years, Aurora is taking the stance that the market has been habitually undersupplied, and that demand from things like derivatives, and the potential to export medical cannabis to places like Europe will continue to soak up supply. In the current quarter, the company was able to sell $20 million of cannabis at a 60% gross margin in the wholesale market as the industry was not able to source enough high-quality product.”

The analyst added, “In the very near-term, management has stated that in Alberta, a number of new stores are coming online and have ordered product ahead of opening, and that it may take some time for that product to sell through. This creates a modest oversupply in the current quarter, but not with relation to the longer-term outlook in Canada.”

Mattson rates ACB a Buy along with a $9.00 price target, which implies about 150% upside from where the stock is currently trading. (See ACB’s price targets and analyst ratings on TipRanks)

Canopy Growth (CGC)

Canopy Growth is in a similar place as Aurora, with the exception of not having the international reach it has. Yet it does have the additional outlet of the research lab in America. Again, if that becomes something beyond a one-off deal, it will be a decent source of revenue for Canopy.

The ongoing concern for Canopy is its lack of a clear vision as to what type of business model it has. Not that long ago it identified primarily as a recreational pot company, and since then has talked about being a medical cannabis company.

It must get long-term leadership in place to make the vision of the company clear and show how they’re going to steer the company to its desired end.

As for oversupply, Canopy is in a similar position as Aurora and Aphria as far as Canada goes, and has been doing well in increasing medical sales, even as recreational sales have declined.

Further out Canopy won’t have the production capacity of Aurora, but it’ll probably be several years before that becomes a factor in revenue.

For now, I don’t see Canopy having much of an oversupply problem over the long term. It will probably continue to underperform until the retail stores are opened in sufficient numbers to have a significant impact on revenue and earnings.

It’s clear that Wall Street is largely divided between the bulls and the fence sitters when it comes to Canopy’s market opportunity. In the last three months, the cannabis giant has landed 8 ‘buy’ ratings vs. 8 ‘hold’ ratings.That said, the consensus average price target points to $34.64, or nearly 74% upside potential for the stock. This suggests that by consensus expectations, for now, the bulls win on Canopy. (See Canopy stock analysis on TipRanks)

Aphria (APHA)

Aphria is the third-largest company in Canada as measured by production capacity, so faces the same challenges and opportunities Aurora and Canopy Growth do.

One difference it has with Canopy Growth is it was awarded five licenses in Germany to produce cannabis, as has Aurora. Canopy went a different route when it was snubbed by buying C3 CAnnabinoid Compound Company in Germany. At the time of the announced deal it was serving approximately 19,500 patients.

As for Aphria with its licensing deal in Germany, the demand growth there looks very strong, with the German medical cannabis market expected to surpass 1 million customers by 2024, according to Prohibition Partners.

While Aphria is among the big three in Canada, its full production capacity will only be about half that of Canopy Growth, and much further behind Aurora Cannabis when it reaches full production capacity.

In the near term this shouldn’t be an issue though, even as the smaller cannabis companies have benefited from the slow rollout of licensed stores against their larger competitors. That is changing, and Aphria will definitely get its piece of the Canadian market as its many smaller competitors start to wilt and fall away.

Wall Street likes the risk/reward factor at play here, as TipRanks showcases a “strong buy” consensus rooting for Aphria’s success. In fact, the consensus of analysts following Aphria is that this stock could soar nearly 70% over the next 12 months, rising from $5.14 and approaching $8.59 per share. (See Aphria stock analysis on TipRanks)

Conclusion

The so-called oversupply situation in Canada, in my view, doesn’t exist at this time as measured by supply and demand. There is too much supply because of the low number of retail outlets, which the companies believed would be much further along in numbers, and increased capacity accordingly.

I would have a different view if demand was actually low, but that isn’t the case. We really won’t know the full oversupply story until the number of retail stores in Canada approach their saturation point, which is going to take awhile.

In the meantime, these three companies will have the equivalent of an increase in demand based upon the pace of store openings. Combined with the expected decline in legal and illegal competitors, they should get a much larger market share than is now anticipated.

With the other sales outlets and changing market conditions that will favor them, I don’t see oversupply having any significant impact on these companies in the long term, and a limited amount in the short term.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy tool, a newly launched feature that unites all of TipRanks’ equity insights.

Why Cannabis Legalization in Other Parts of the World Could Be Bad News for North American Pot Stocks

- Posted By : Greenweedfarms

- POLITICS

- Leave a comment

Why Cannabis Legalization in Other Parts of the World Could Be Bad News for North American Pot Stocks, Cannabis legalization is generally good news for the industry and companies looking to expand into other parts of the world. However, that’s not necessarily always the case, as it also creates opportunities for those countries to start becoming exporters of cannabis themselves, and they could end up competing head-to-head with large North American producers. Canada-based Aurora Cannabis (NYSE:ACB) prides itself on its global presence, and according to its website, it has a footprint in 25 countries and has 15 global production facilities.

While that’s great for growth opportunities, especially when the U.S. market is still off-limits for the foreseeable future, the company’s presence in more markets also means it will face more competition. Not only will it be competing with other cannabis stocks, but also many of its peers that are vying for positions in those markets.

A good example is hemp, which is legal in the U.S. thanks to the farm bill passed last year. And while Aurora and other Canadian companies see this as an opportunity to expand into the U.S. market, the problem is that they will not only be competing with other Canadian producers but with U.S. hemp producers as well.

Zimbabwe targets hemp as its next big export

In Zimbabwe, there is a pilot project underway that will see industrial hemp being grown on prison grounds in Harare. One of the motivations for the government to permit hemp cultivation is that it could be a substitute for tobacco, which according to 2017 data, made up more than half of the country’s total exports.

With hemp growing in popularity for cannabidiol-based products, it could present a significant opportunity for the country to diversify its exports and be less dependant on tobacco. And that could lead to its products making their way to North America and other parts of the world as well.

Last year, Zimbabwe became the second African country after Lesotho to legalize marijuana for both scientific and medical use.

Thailand is another country that’s looking to expand its cannabis program

Asia is another part of the world where cannabis legislation just hasn’t made much progress. But one country, Thailand, has been receptive to medical marijuana. It’s not only building Southeast Asia’s largest medical marijuana facility, but it’s also expected that legalization will be expanded to allow individuals to grow as many as six cannabis plants for medical purposes. And while that’s good news for the industry, the government is looking to be the main producer of medical marijuana, with the Government Pharmaceutical Organization projecting that by February, it will have 1 million bottles of cannabis oil, containing 5 milliliters each, available.

And while it may present an attractive opportunity for North American producers, Thailand looks to be wary of allowing foreign competitors to come in and take over the industry. And that could help local companies succeed and build up their presence on the global stage.

Why North American cannabis companies could be in trouble

A year ago, the opportunities presented by the legalization of cannabis in many parts of the world would have excited investors. Expansion and growth were all the talk in the industry. But with a company like Aurora Cannabis coming under fire for its poor financials and the amount of cash it’s been burning through, it may no longer be an easy decision to simply expand in a part of the world because cannabis has been legalized there. There’s going to have to be a good business case for it.

Investors need to look no further than Aphria (NYSE:APHA) as to how quickly an international strategy can go sideways. Last year, the company’s stock took a big hit following allegations that it vastly overpaid for assets in Latin America and the Caribbean. Investors are paying much closer attention to the actions companies are taking to make themselves more or less profitable. And expanding for the sake of expansion isn’t going to win over shareholders, not when it’s going to saddle the company with more expenses along the way.

Key takeaways for investors

With the markets being more sensitive to a company’s financial statements, it’s likely that cannabis producers are going to have to put the brakes on international expansion. And that means international growers will have an opportunity to build up their own positions in the industry and could end up competing with North American companies in Europe, Canada, and other markets where hemp or medical marijuana has been legalized.

For companies like Aurora and Aphria that are banking on international growth, it could impact their market share and overall valuations. With more of a focus on profitability, they won’t be able to be aggressive in pursuing new market opportunities. And while they may become stronger companies by improving their bottom lines, their positions internationally will likely get weaker. The good news, however, is that the international markets are still a long way from being as developed as those in North America, and that gives Aphria and Aurora a lot of time to strengthen their financials in preparation for what could prove to be a big battle on the global stage.

Legal Marijuana Is Coming To Illinois, But What Will Happen If You Bring It To Missouri?

- Posted By : Greenweedfarms

- GROWING

- Leave a comment

Legal Marijuana Is Coming To Illinois, But What Will Happen If You Bring It To Missouri?, While people who are at least 21 will be able to purchase recreational marijuana legally starting on Jan. 1 in Illinois, it doesn’t mean they’ll be able to bring the cannabis into Missouri.

However with such ease of travel between the Missouri and Illinois, with multiple bridges connecting the two states in the St. Louis-area, someone is bound to bring legally purchased weed from the Land of Lincoln to the Show Me State.

On Jan. 1, Illinois residents will be allowed to possess any combination of 30 grams of cannabis flower, 5 grams of cannabis concentrate, and 500 milligrams of THC contained in a cannabis-infused product. Non-residents will be able to possess half of those amounts.

Illinois’ law also prohibits transporting cannabis across state lines.

If other state’s experiences are any indicators, Missouri will probably see people bring weed that is legal in Illinois across the river. After Colorado legalized marijuana, Nebraska started seeing more arrests for marijuana possession.

Nebraska and Oklahoma even sued Colorado because more people were bringing in marijuana into the two states and overwhelming police and courts. The U.S. Supreme Court declined to hear the case.

HCI Alternatives, a marijuana dispensary in Collinsville, expects to do at least $20 million in sales next year when recreational weed becomes available. Among the factors is the proximity to St. Louis. And the Green Solution in Sauget is even nearer to the river.

Possible charges

So what could happen if you bring your legal cannabis into Missouri?

Possessing between 10 and 35 grams of marijuana in Missouri can be charged as a class A misdemeanor, which could carry up to a year in jail and a fine of up to $2,000, according to the Missouri Sentencing commission.

On Jan. 1, Illinois residents will be allowed to possess any combination of 30 grams of cannabis flower, 5 grams of cannabis concentrate, and 500 milligrams of THC contained in a cannabis-infused product.CREDIT DAVID KOVALUK | ST. LOUIS PUBLIC RADIO

Persons caught with less than 10 grams of marijuana could face a Class D misdemeanor, which carries up to a $500 fine.

Whether to charge those misdemeanors is up to the local prosecutor.

Susan Ryan, spokeswoman for the St. Louis City Circuit Attorney’s Office, said the office doesn’t always file formal charges for possession of 100 grams or less of marijuana, and instead would try to get offenders into diversion programs.

A possession charge also may be filed if the the offense was committed in connection with another crime, such as illegal gun possession or a robbery, Ryan said.

“We’re trying not to affect casual marijuana users,” Ryan said.

If an officer finds you have marijuana, he or she has the option to write a ticket for an ordinance violation, Ryan said.

St. Louis City passed an ordinance in 2018 that reduces the fine to $25 for being caught with a small amount of marijuana.

Missouri is gearing up to allow people to use marijuana for medical reasons, however it would require people to have a medical marijuana card.

Missouri residents may start applying for medical marijuana cards, but dispensaries in the state aren’t expected to be open until the late spring or early summer of next year.

Loading…

Representatives from the St. Louis Metropolitan Police Department were unavailable to be interviewed about how it would handle the possibility of more people possessing recreational marijuana because of Illinois’ legal program but provided a statement.

“The police department will continue enforcing applicable local, state and federal laws which regulate controlled substances, including marijuana,” the department said. “At what point an individual becomes eligible to legally purchase, use and possess marijuana in Missouri depends on when the program is implemented by the Missouri Department of Health and Senior Services. The police department is monitoring these changes and is prepared to adapt enforcement procedures accordingly.”

St. Louis County Police declined to comment for this story.

Joseph Bustos is a reporter for the Belleville News-Democrat, a news partner of St. Louis Public Radio.

Send comments and feedback about this story to feedback@stlpublicradio.org

California cannabis group wants tighter vaping-safety rules

- Posted By : Greenweedfarms

- NEWS

- Leave a comment

California cannabis group wants tighter vaping-safety rules, An alliance of major legal marijuana businesses in California urged the state Monday to adopt tougher safety rules for ingredients and devices used in vaping and get tougher with illegal shops, amid an outbreak of a mysterious illness apparently linked to vaping.

The recommendations from the industry group — Legal Cannabis for Consumer Safety — come as health officials continue to investigate a wide range of products and chemicals that could be causing the illness that have sickened over 1,600 people nationwide. Most cases have involved products that contain the marijuana compound THC, typically obtained from illegal sources.

In a letter to Gov. Gavin Newsom, the group said it’s eager to heighten the safety of cannabis vaping while seeing more funds devoted to closing illegal pot shops that number in the thousands in California, home to the world’s largest legal pot market.

Among its proposals, the group says regulations should expressly ban the use of additives, cutting agents and artificial flavoring known to be harmful in cannabis vaping products. The group also wants $10 million added to funds to close illegal retailers. It also recommended more stringent standards for heavy metal testing of vaping hardware — the devices that are used to turn concentrated cannabis oil into a vapor.

“It is unacceptable that Californians face risks from unregulated and unsafe vapes. It is also critical that — like any other public health issue — we implement effective solutions that are based on data and facts, rather than fear, to address the root cause of these issues,” the group wrote.

“As the stewards of this supply chain, we are eager to engage in efforts to further heighten the safety of cannabis vaping and mitigate the risks posed by the burgeoning illicit market,” the group, which also requested a meeting with Newsom, wrote.

The group includes cannabis growers, manufacturers, retailers, testing labs and industry groups, including the California Cannabis Industry Association, vape manufacturer Loudpack, Flow Kana, which distributes cannabis products from small, outdoor farmers, and the online delivery marketplace Eaze.

___

Blood is a member of AP’s marijuana beat team. Follow the AP’s complete marijuana coverage: https://apnews.com/Marijuana

California Seizes More Than $1.5 Billion In Illegal Marijuana

- Posted By : Greenweedfarms

- LAW

- Leave a comment

California Seizes More Than $1.5 Billion In Illegal Marijuana, California authorities announced they seized more than $1.5 billion worth of illegal marijuana in fiscal year 2019, or the rough equivalent of the state’s legal market for cannabis.

More than 953,000 plants were seized from 345 raided grow sites around the state. Authorities arrested 148 people and confiscated 168 weapons under California’s Campaign Against Marijuana Planting, or CAMP program.

“Illegal cannabis grows are devastating our communities. Criminals who disregard life, poison our waters, damage our public lands, and weaponize the illegal cannabis black market will be brought to justice,” said Attorney General Xavier Becerra in a statement on Monday.

The value of the seizures was based on the estimated wholesale price of $1,600 per plant.

A cannabis industry expert quoted by the Associated Press said that wholesale costs are doubled for the retail marijuana market, so the state seizures would be worth $3 billion of illegally grown marijuana.

California’s seizures are “equal to our entire regulated market, said Jerrod Kiloh, president of the United Cannabis Business Association.

Although cannabis has been legalized for use in California, there is still a large unlicensed black market,” said Robert Paoletti, Coordinator Colonel, California National Guard Counterdrug Task Force. “Our participation works to prevent this illegal market in order to promote a fair market place for those growers, producers, and vendors who choose to operate within the system that the voters approved.”

California voters legalized recreational marijuana in 2016. However the illegal market is still alive, in part, because consumers can avoid paying taxes on their cannabis.

Industry experts say the legal market is struggling to compete with the illegal market for other reasons.

“Regulators are ambivalent, publicly supporting the value of moving cannabis out of the illicit market and redressing the harms prohibition has done—such as overincarceration of minorities for minor possession offenses—but they have often proved unwilling to allow enough stores and keep regulatory and tax costs low enough to make the legal market competitive,” according to a report by industry analysts Arcview Market Researc and BDS Analytics.

NYC Bans Pre-Employment Testing for Marijua

- Posted By : Greenweedfarms

- HEALTH

- Leave a comment

6 Strains for People Who Love Pine Terpenes

- Posted By : Greenweedfarms

- STRAINS & PRODUCTS

- Leave a comment

6 Strains for People Who Love Pine Terpenes You ever walk into the deepest depths of the woods, take a deep breath, and get a refreshing whiff of pine aromas? What if I said you could get that same experiencing from sniffing certain cannabis strains and terpenes?

Just like citrus, berry, and gassy flavors, cannabis can also provide piney aromas and flavors. Many expect these flavors to be reflective of pinene—a terpene found in cannabis, pine cones, and conifers that promotes alertness—however, a variety of terpene profiles can produce this aromatic experience.

So, for that reason, here’s a look at six strains with piney qualities and their terpene and cannabinoid profiles. Surprisingly, some of them feature no pinene at all.

Dutch Treat

Primary terpenes: Terpinolene, myrcene, ocimene

Cannabinoid profile: THC-dominant (17-21% on average)

Dutch Treat is a popular strain that’s become an essential in Amsterdam coffeeshops. It has dense, sticky buds, but more importantly, it has a sweet flavor of pine trees that will slap you right on the nose. One would assume these flavors are reflective of pinene, however, Dutch Treat’s main terpenes are terpinolene, myrcene, and the rare ocimene.

From these terpenes comes a variety of effects, however, most people expect a cerebral high that’ll have you up and alert yet also relaxed, making Dutch Treat a great stain for creative tasks.

Find Dutch Treat Nearby

Larry OG

Primary terpenes: Myrcene, limonene, caryophyllene

Cannabinoid profile: THC-dominant (16-20% on average)

Larry OG is some goddamn fire, let me tell you that straight off the bat. Also called Lemon Larry, this cross of OG Kush and SFV OG—an OG Kush phenotype—this has familiar citrus scents followed by strong piney tones that’ll please the palate of any OG connoisseur.

These flavors are driven by a combination of myrcene, limonene, and caryophyllene. From those terpenes comes an experience that most people say is powerful but not overwhelming, reminiscent of the highs of many OG Kush phenotypes and crosses.

Find Larry OG Nearby

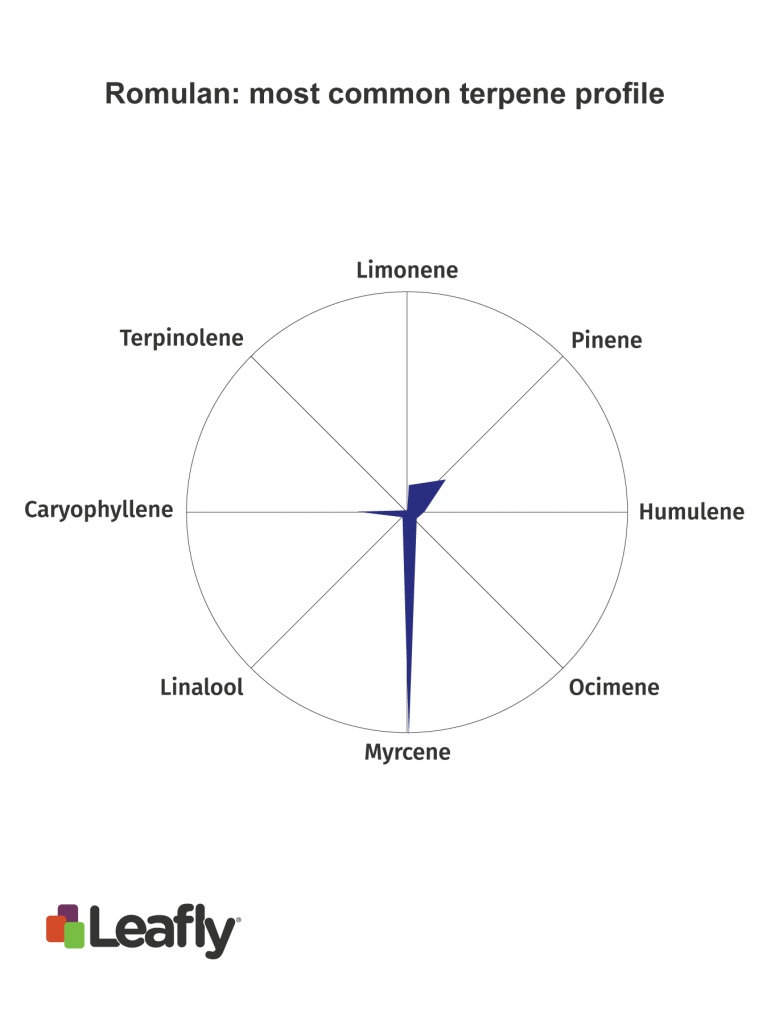

Romulan

Primary terpenes: Myrcene, pinene, caryophyllene

Cannabinoid profile: THC-dominant (13-18% on average)

Named after the alien Star Trek race, Romulan is a powerful strain revered for its potent qualities. Its dense, frosty buds produce an intense pine scent that’ll send your senses into a relaxing whirlwind.

An indica-dominant plant, many Romulan growers insist it has qualities that people would associate with sativas, which is a perfect example of why terpene and cannabinoid profiles are a stronger guide for perceived effects.

The terpene profile most likely responsible for Romulan’s piney aroma and cerebral high that will end in a deep and relaxing body high, holds an abundance of myrcene, pinene, and caryophyllene.

Diamond OG

Primary terpenes: Pinene, myrcene, caryophyllene

Cannabinoid profile: THC-dominant (17-20% on average)

Diamond OG is one of the most uniquely flavored cannabis strains I’ve come across in a while. It has an earthy and piney flavor like many OG strains, however, a friend of mine cold-cured a batch of it for over a year, bringing out an intense tropical flavor.

A cross of OG Kush and an unknown strain, the terpenes responsible for its flavors are pinene, myrcene, and caryophyllene. It is worth noting that it’s pretty rare for a strain to be dominant in pinene.

The effects of this strain can vary, though most feel a mental euphoria and full-body relaxation that pairs nicely with a post-work chill-out.

Find Diamond OG Nearby

Jack Herer

Primary terpenes: Terpinolene, caryophyllene, pinene

Cannabinoid profile: THC-dominant (16-20% on average)

One of the most influential strains (and people) in all of cannabis, Jack Herer is a spicy and pine-scented cross of a Haze hybrid with a Northern Lights #5 x Shiva Skunk cross.

Its rich genetic background results in a variety of phenotypes, each with its own unique qualities, however most people usually describe Jack as blissful, clear-headed, and creative.

Find Jack Herer Nearby

Deadhead OG

Primary terpenes: Caryophyllene, limonene, myrcene

Cannabinoid profile: THC-dominant (16-21% on average)

Deadhead OG crosses Chemdog 91 and SFV OG Kush, so off top, you know it’s some straight heat rock. Most people describe the high as stimulating in the mind but relaxing in the body.

Deadhead OG’s terpene profile contains abundant amounts of caryophyllene, limonene, and myrcene. Known as a very hearty and pungent strain, most phenotypes present an earthy, piney smell and taste, though some have stronger diesel aromas, which makes sense considering its lineage.

Find Deadhead OG Nearby

FDA Puts America on Notice: Stop Touting CBD Claims

- Posted By : Greenweedfarms

- POLITICS

- Leave a comment

FDA Puts America on Notice: Stop Touting CBD Claims America’s booming CBD market received a cold splash of reality this week when the US Food and Drug Administration (FDA) issued a letter to Curaleaf, a major US cannabis and CBD brand, warning that some of its product marketing violates the Federal Food, Drug, and Cosmetic Act.

Reaction from vendors and investors was swift and harsh. Within 24 hours the national drug store chain CVS announced it would remove some Curaleaf CBD products from its shelves. Shares of Curaleaf stock fell 8% in a day.

All that happened because of a single warning letter—not a product recall, a tainted batch, or an expose on 60 Minutes. It’s worth noting that the FDA did not warn that Curaleaf’s products themselves were illegal. Rather, it was the way in which Curaleaf marketed the products.

CBD Ties the FDA Into Knots

The FDA currently has nothing to say about the legality or illegality of cannabidiol (CBD). That may change. The agency has fast-tracked a review of CBD products, held a widely seen public hearing on the substance at the end of May, and many are expecting FDA officials to announce some sort of regulatory action by the end of 2019.

The FDA has made one thing very clear about CBD, however. The agency will not tolerate manufacturers making pharmaceutical-like claims about the product. If you claim your product will heal cancer or alleviate pain, and it is not an FDA-approved drug, the agency will come knocking at your door.

Make No Claims

The Curaleaf file wasn’t even a heavy lift for the FDA. According to the warning letter, an agency official simply went to Curaleaf’s website and took notes on the phrases posted.

Here are a couple of the phrases that got the company in trouble:

- “For chronic pain,” on the page for the company’s Relieve brand CBD Disposable Vape Pen

- “Soothing tincture for chronic pain,” on the page for Relieve’s CBD Tincture

The FDA also objected to Curaleaf posting basic health claims about CBD on pages unrelated to products: “Some of the most common reasons to use CBD oil include… Chronic pain… Mental conditions like anxiety, depression, and PTSD…”

It’s a Complex Process

While there are studies and anecdotal evidence indicating that CBD may help some patients suffering from those conditions, it’s not accurate to claim that CBD can cure or offer “quick relief” from all those maladies with just a dose. That’s not to say CBD is ineffective in all cases. It means there’s more complexity involved.

Curaleaf isn’t trying to peddle snake oil. It looks like the company’s marketing and brand design team outkicked their legal coverage while trying to condense complicated information into bite-size phrases that fit in a tweet or on a web page. But at the same time, the FDA hasn’t exactly been hiding their prickliness over health claims made for cannabidiol.

Everybody involved with CBD—from cannabis and hemp growers to entrepreneurs, regulators, and patients—is struggling to handle this new product responsibly and legally. Outside of a handful of legal cannabis states (where CBD is strictly regulated and tested), there are almost no rules to go by.

Curaleaf is not the only company making health claims about its products. It’s likely the FDA went after the Wakefield, Massachusetts–based company precisely because it’s a national brand working with CVS, and the federal agency wanted to make a loud and clear statement to all the other CBD brands out there. A quick scan of the headlines in yesterday’s media will confirm: Mission accomplished.

‘Cannabis Saved My Life’: Veterans Share Stories of Healing and Recovery

- Posted By : Greenweedfarms

- HEALTH

- Leave a comment

‘Cannabis Saved My Life’: Veterans Share Stories of Healing and Recovery, once a week, a handful of military veterans gather at the Seattle Vet Center to practice the art of writing and the process of healing. Some write fiction. Others reveal themselves in memoir. https://greenweedfarms.com/blog/

“We help people find tools to tell their own stories,” says Warren Etheredge, who teaches and leads the sessions. “I’ve been a teacher at every grade level for 30 years, and this is easily the most rewarding work I’ve ever done.”

7 Veterans, 7 Stories

To mark Veteran’s Day, Nov. 11, this year Leafly is partnering with the Red Badge Project to bring some of those stories to life. Etheredge recently asked writers in his group to create a story that touched in some way on cannabis—a common topic of conversation among those managing PTSD.

“For the younger vets, it’s easier to talk about cannabis,” Etheredge recently told Leafly. “But for some older folks, from the Vietnam generation, it’s still something that’s not talked about a lot. Those who use it, swear by it. For some writers, their reaction was: ‘Oh please, let me spread the word.’”

While the rest of society is breaking down taboos around cannabis, it’s still a difficult topic in the military. A number of Red Badge writers, in fact, felt the need to use authorial pseudonyms because of the risk to their careers or VA benefits.

We’ve provided a few opening lines from each story, below. Click on the link to read the full piece.

We’ve also recorded the stories, and collected them in a short audiobook:

Aaron Patrick

Aaron Patrick is a social worker and dad from Washington state. He served in the Washington Army National Guard from 2002 to 2010, including a deployment to Iraq during “The Troop Surge”. Aaron began his enlistment as an Avionics Equipment Repairer but reclassified to Military Police and deployed as a Military Police sergeant. His favorite strain is Sugar Plum.

Bringing Back the Feelings

I can’t sleep unless I drink myself unconscious. It seems I can’t do much of anything without a drink. They say alcohol is an anesthetic, but I’m not drinking to numb any pain. I’m drinking because I can’t feel anything at all. I’ve cauterized my feelings.

J. Brad Wilke

J. Brad Wilke is a co-founder and principal of Smarthouse Creative. Brad holds an MBA from the University of Washington’s Foster School of Business, a Master of Communication in Digital Media from the University of Washington’s Department of Communication, and a Bachelor of Science from the U.S. Military Academy at West Point. He received an Honorable Discharge from the U.S. Army in 2003, having attained the rank of captain.

Just Follow Orders

As a non-combat veteran of the U.S. Army, I’ve never had the need to use cannabis to alleviate or minimize the effects of PTSD. My cannabis use has always been purely recreational and didn’t begin until well after I transitioned out of the service. My military experience was more Robert Altman’s M*A*S*H than Stanley Kubrick’s Full Metal Jacket. I hated people telling me what to do and I loathed the lack of agency that began as a cadet at West Point and lasted until I finally transitioned out of the service in late 2003.

Shortly thereafter, I took my first hit off a joint.

Sam Arrington

Sam Arrington grew up on the east coast and enlisted in the US Army after the attacks on September 11, 2001. He served eight years, including combat tours in Iraq and deployments as a combat advisor in Lebanon and Yemen. He now lives in Washington with his wife and two sons and spends his days teaching, writing, and coaching baseball.

A Time To Be Still

“This doesn’t kill kids. It kills adults, but not kids.”

Early on a doctor had told him that. Now he just repeated it whenever the silence took him to some place he didn’t want to be.

A small girl was sleeping on the bed in front of him. Her frame was overwhelmed by the bulk of the large bed. She was asleep and the last of the daylight was fading on the mountains outside the window of her hospital room. It cast a beautiful rose glow on her skin.

A nurse entered the room.

“Take a break. I will come get you if I need to.”

Maggie S.

Maggie S. spent six years in the active duty Army as a public affairs specialist and broadcast journalist. She met her husband while stationed in Germany and they have been married for over 20 years. She has three children, Timothy, Madison and Aidan.

Try the Home Grown

When everything got really bad, Mom thought it would help. I was, of course, hesitant since I didn’t really have a decent track record with anything beyond say Tylenol. But, Mom decided, after it had been brought up that we would try it together. She, at 62 and I at 35 would have some cannabis together in an attempt to calm my mind, and my body from 6 years of service that wrecked havoc on both.

While I had certainly tried it once before – it was before, before everything. I was 18, and in Amsterdam, then Denmark, then Norway, and finally what was previously East Germany. The last of my cousin’s stash was imbibed at the top of a cathedral where my sister, cousin and I all had to huddle together and block the wind so the makeshift wooden pipe bought in desperation in Amsterdam could be lit.

Skip Nichols

Skip Nichols is a Marine combat veteran who served in Vietnam from 1967-68. He and his wife, Paula, live in Walla Walla, Wash. They have two daughters and two grandsons. Nichols’ hobbies include writing and scuba diving. He has a degree in wildlife biology and worked as a newspaper editor for 40 years.

Introduction to War

Six black body bags lay in a row, splattered with the red mud that stained everything on top of the small hill south of the DMZ in Vietnam.

Fred Cleary whistled while Bobby Erl Baker remained silent as they struggled to pick up the bodies, Marines killed at nearby Con Thien during a massive bombing siege by the North Vietnamese Army. When they finished loading the bodies on a UH-34 helicopter, Baker was visibly shaking.

“What’s the matter?” Cleary asked. “At least it wasn’t you.”

Baker didn’t answer, but he wondered if someday someone would one day load his body on a chopper. The war suddenly seemed very real.

Reg Doty

Reg Doty was born in 1947 and went to war in 1967. He married his wife Jenise in 1971, graduated from Washington State University in 1976, the same year their son was born. He has been diagnosed with severe PTSD from his war years. “I have great difficulty talking to people,” he says, “but I try to make up for that through writing.”

Redneck Buffet

After two tours partaking in the great “Asian vacation” I was looking forward to starting my life over as an expatriate in a place far away from the insanity that hijacked my dreams and left my spirit weary: a place where I might find my way to moral redemption? Fate intervened, though, when I met a young woman with whom I shared much in common. So as it happened we became expatriates together, not on the far side of the world, however, but in the community where she was born and raised, deep within the confines of eastern Washington State.

We all know that it takes faith to move mountains, but coupled with love and kindness you just might be able to save souls too. I was a hard case, to be sure, but here was someone who wasn’t about to give up on me. Persistence and perseverance is a motto we should all live by and my beautiful friend put meaning and action into those words. Perhaps even a half-wit like me could get swept-up in a campaign to salvage himself.

L.J.

L.J. is a U.S. Air Force Veteran and stand-up comedian. He comes from a tribal community in Minnesota and now lives in Seattle with his two kids.

Secret Cigarette Lighter

In the late 90’s I bought a ragged old 1987 Toyota pickup truck to drive around base and get me in to town.

This was when I was stationed at Edwards Air Force Base in the Mojave desert.

At one time this base was considered a remote location and the military gave personnel living there a small stipend for having to be in the middle of nowhere. Somewhere along the way, the powers that be in the defense department decided to move the checkpoint gate five miles closer to town in order to deny the stipend and be able to say the base had easy access to civilization even though the junior enlisted dormitories and other base housing did not move five miles closer to town.

Etheredge, a nationally known film critic, curator, and founder of The Warren Report, is one of eight writers who work with dozens of veterans in The Red Badge Project, a nonprofit group that helps wounded warriors “rebuild their individual sense of purpose and unique individuality” through the creative process of storytelling.

The group was created six years ago by Tom Skerritt, the actor, director, and Air Force veteran; and Evan Bailey, a former US Army captain. Red Badge groups now meet in Vet Centers around the Pacific Northwest, from Spokane to Walla Walla, Everett, and Federal Way.

Cool Down With These 8 Chill Cannabis Products

- Posted By : Greenweedfarms

- STRAINS & PRODUCTS

- Leave a comment

Cool Down With These 8 Chill Cannabis Products Temperatures are starting to rise now that summer is closing in. It’s the perfect time for relaxing by the pool, cranking up the A.C., swimming in the ocean, or taking advantage of some cool cannabis products.

Find Cool Summertime Strains Nearby

From infused ice cream to cooling balms and medicated cold brew, discover eight unique ways cannabis can help you beat the heat.

Ice Cream by Remedy Ice Cream Company

With eight exciting flavors to choose from, this premium, medicinal ice cream from the Remedy Ice Cream Company makes the perfect summer treat (with a little twist). With natural, hand-selected ingredients, each 4-oz portion contains 80mg of THC. Available flavors include Reese’s Pieces, Mayan Spiced Chocolate, Cocoa Menthe, Cookies & Dream, Madagascar Vanilla Bean, Earl Grey Blueberry, Salted Caramel, and Coffee. Or switch it up and create your own dream flavor!

Available in: Canada

G Drink Original Lemonade by GFarmaLabs

There’s nothing quite as refreshing as a tall glass of lemonade on a hot summer’s day. GFarmaLabs’ cannabis infused Original Lemonade contains 100mg of THC. Along with the classic lemon flavor, it’s also available in pink and strawberry lemonades. Serve it ice-cold on a sweltering day or keep it in the cooler on the way to the beach.

Available in: Most recreational and medicinal states

Coava Cold Brew by Level+

Each 16oz bottle of Level+ buzzy Coava Cold Brew contains 5mg of THC, making it the best choice for a pleasant, light dose each time you need a refreshing jolt. Say goodbye to hot coffee in the already hot heat, and say hello to a cool alternative with just as much caffeine power.

Available in: Oregon

Popsicles by Remedy Ice Cream

Remedy Ice Cream was so good, we had to give them a second shoutout. Creamsicle, Lime Coconut, and Rocky Mountain Fudgesicle are three incredible flavors of the infused popsicle line by this innovative company. Each treat contains 40mg of THC and two of the three options are naturally vegan. Try one or try them all for the ultimate summer pick-me-up.

Available in: Canada

Synergy Cool: CBD & THC Cooling Balm by Dixie Elixirs

Dixie Elixirs combines 50mg of CBD, 50mg of THC, and a litany of invigorating oils for a balm that will send a pleasant shiver down your spine (or anywhere else you apply it). Peppermint, eucalyptus, pine, and chamomile are just a few ingredients making up the 20 essential oils in the soothing CBD & THC Cooling Balm.

Available in: Colorado, California, Nevada, and Arizona

Petra Eucalyptus Mints by Kiva Confections

Petra Eucalyptus Mints from Kiva Confections are the perfect quick-fix for both stale breath and stifling heat. Each individual mint has 2.5mg of THC, allowing accurate and precise dosing or microdosing. They are sugar-free with refreshing eucalyptus oil that will revitalize the senses.

Available in: California

Spring Citrus Sparkling Drink by Sprig

Sprig’s zesty Citrus Sparkling Drink is a light refreshment best served on the rocks. With 45mg THC per can, it’s a potent drink practically made for unwinding after a long day.

Available in: California

Mellow Mint Stillwater Tea by Stillwater Brands

A tall glass of iced tea is a welcome summer tradition. Stillwater’s Mellow Mint Tea puts a twist on this hot-weather staple by boasting invigorating flavors of mint with 2.5mg of THC per bag. Simply brew up a batch, allow to cool in the fridge, then enjoy in a tall glass filled with ice for an enlivening cannabis iced tea.

Available in: Colorado